Guidance for the big picture and finer details

A Disciplined Process for Your Financial Success

At Perreira Wealth Advisory, we believe that planning is the foundation for achieving your goals both in life and at death. By taking a structured approach, we build customized portfolios designed to ensure that those goals are met. Our trusted process delivers personal attention and a disciplined framework, helping you navigate the complexities of your financial life with confidence.

- Discovery: Understanding You

The first step in our journey together is a deep discovery phase. We take the time to get to know you—your unique goals, financial situation, investment experience, and risk tolerance. This allows us to tailor our services to meet your specific needs. During this process, we also explain how our team operates, providing you with a clear understanding of our robust capabilities and how they can be customized for you.

- Outlining: Creating your Financial Plan

Once we’ve gathered the necessary information, we work as your financial counsel to analyze it thoroughly. This evaluation guides the creation of your personalized financial/estate plan. When needed, we coordinate with your other trusted advisors—such as your lawyer or accountant—to ensure your plan is cohesive and streamlined. At the end of this phase, we present our recommendations, addressing any questions and outlining next steps.

- Implementation: Executing with Precision

With your approval, we move forward to execute your custom strategy, using the extensive resources available to us through Raymond James. We implement your customized portfolios and incorporate additional services as needed, ensuring you and your family enjoy lasting financial peace of mind.

- Ongoing Monitoring and Review

After everything is is in place, we continually monitor if you are on track to ensure we are aligned with your objectives. Our team provides ongoing reporting and conducts periodic reviews to adapt your plan as your life changes. We also review essential aspects such as your insurance and estate planning to ensure that all elements of your financial future are covered.

Our Client Roadmap

Our process is designed to give you confidence and clarity every step of the way. Here's a snapshot of the roadmap we follow:

- Onboarding & Discovery: We begin by gathering data, assessing your risk tolerance, opening accounts, and transferring assets.

- Customization: This phase includes determining your financial goals and objectives, discovering the right strategies, and implementing your customized portfolio.

- Implementation: After aligning your portfolio with your goals, we your financial plan.

- Review: We regularly review your investment strategy and update your financial plan to ensure it stays on course.

- Ongoing Action: As we review your plans, we make necessary changes to stay ahead of your evolving needs.

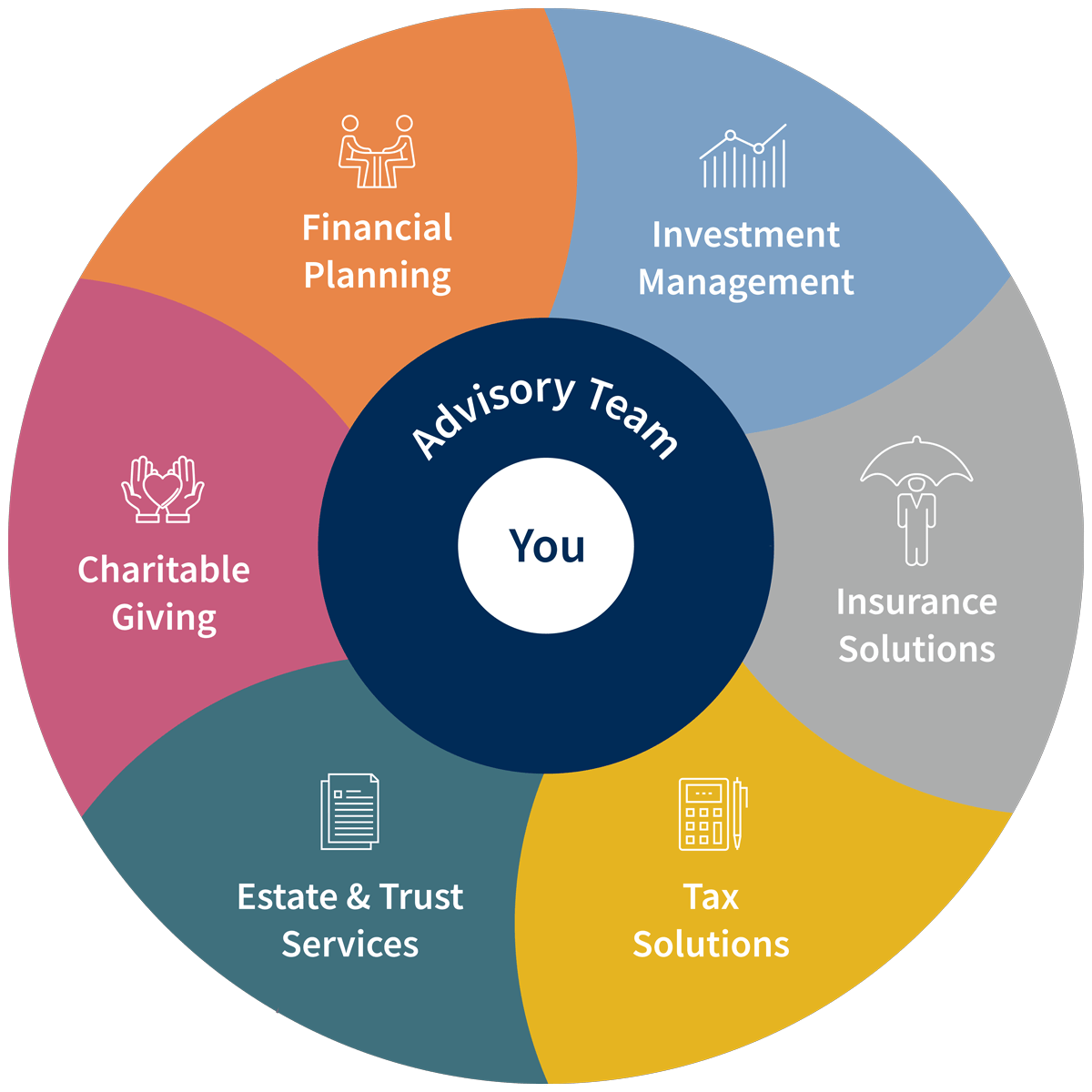

Total Wealth Solutions

Our business is you and your financial well-being

Through our Total Wealth Solutions approach, we collaborate with you and help you define and reach your financial goals at every stage of life. Whether you’re planning for retirement, growing a business, or transferring wealth to the next generation, we create a cohesive strategy that provides the best solutions to fit your individual needs.

Empower your wealth journey with personalized advice from our dedicated team of specialists that help incorporate:

-

Financial planning is the foundation upon which your total wealth management strategy is built and defined. A well-crafted plan for your life is where the discovery journey begins.

- Establish what wealth means to you

- Determine your goals and objectives

- Create a customized plan

- Execute action items to make your goals a reality

-

Investment management solutions are available to help build your net worth, preserve it or generate income for life. Through a deep discovery process, we will have the important conversations that help define what wealth means to you; how you want to spend and how you want to invest.

- Determine investment objectives, risk tolerance and time horizon

- Construct an appropriate asset allocation strategy

- Evaluate and select suitable investments

- Perform ongoing portfolio monitoring and rebalancing

-

Insurance solutions are critical to help guard against financial losses due to unexpected events. Providing for and safeguarding those you love from potential risks and uncertainties means building financial protection for them.

- Financially protect your family or business

- Accumulate and transfer wealth using tax-exempt life insurance

- Fund and facilitate a business transfer or continuity cost-effectively

- Guarantee income for life

- Group plans and solutions for businesses and corporations

-

Tax planning is an integral component of wealth management. Its purpose is to help you retain more of the wealth you have worked diligently to earn.

- Minimize tax liability and preserve wealth

- Prepare and file your tax return

- Identify restructuring opportunities to maximize wealth

- Make informed financial decisions

-

Estate and trust services help facilitate your wealth transfer wishes now and in the future. Whether acting as an executor, trustee or power of attorney, Solus Trust an affiliate of Raymond James Ltd. provides expertise to create lasting and meaningful legacies.

- Maintain family harmony

- Ensure diligent care of beneficiaries

- Preserve wealth and avoid financial vulnerability

- Facilitate legacies for generations to come

-

Charitable giving is a positive, life-affirming endeavor. It allows you to give with intention today and leave your mark for the future as you build a lasting legacy.

- Create your family foundation

- Build a charitable legacy

- Maximize impact to your favorite charities

- Initiate a strategic approach to giving